- Who We Are

- Empower Solutions

- Media Library

-

Featured

Local Financial Advisor Completes Advanced IRA Training at National 20-Year Conference Hosted by America’s...No posts found

-

- Events

- Form CRS

- Contact

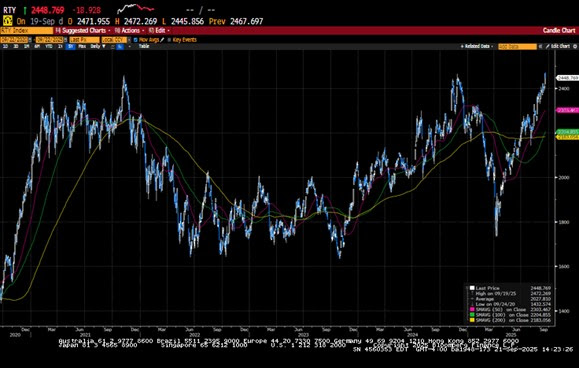

Apprehensive investors pushed markets higher this week, with the small-cap Russell 2000 hitting a new all-time high, while the S&P 500 closed just 50 points below its October all-time high. Economic data,

The holiday-shortened week saw global financial markets trade higher. Increased optimism for a December rate cut, along with some constructive news on the AI front, catalyzed buying across risk assets. Several Fed

The holiday-shortened week saw global financial markets trade higher. Increased optimism for a December rate cut, along with some constructive news on the AI front, catalyzed buying across risk assets. Several Fed

Markets were choppy and ended the week with mixed results. Investors poured into risk assets on the idea that the longest US government shutdown was over, but a more hawkish tone from

US markets rebounded from losses in the prior week as trade tensions between the US and China appeared to ease. President Trump is scheduled to meet with President Xi in the next

Well, the market finally had a significant pullback, but not before the S&P 500 and NASDAQ were able to set another all-time high. The week began with a deal between OpenAI and

Investors sent US markets to another set of all-time highs despite concerns about an extended government shutdown. The U.S. government shutdown was largely dismissed by markets last week, which came as a

The S&P 500 hit a 28th record high for the year before settling lower for the week. Investors endured a choppy week of trading as better-than-expected economic data and better-than-feared inflation data

The major US equity market indices forged another set of all-time highs as investors went all in on risk assets after the Federal Reserve announced a twenty-five basis point cut to its

US equity indices posted another set of all-time highs as investors increased expectations for three, twenty-five basis point rate cuts by year’s end. Inflation data reported for the week essentially gave the

Investors sent the S&P 500 to another all-time high in a holiday-shortened week of trading. President Trump started the week by asking the Supreme Court to expedite a hearing to challenge the

The S&P 500 posted a gain for the fourth consecutive month as investors continued to embrace the prospects of a September rate cut, a robust economic outlook, and strong corporate earnings. The