- Who We Are

- Empower Solutions

- Media Library

-

Featured

Local Financial Advisor Completes Advanced IRA Training at National 20-Year Conference Hosted by America’s...No posts found

-

- Events

- Form CRS

- Contact

The major US equity indices inked a fourth consecutive week of gains as US Treasury yields fell on an in-line CPI print that showed a deceleration of inflation for the first time in three months. Still, Fed Speak suggested the higher for longer narrative is the base case. The market rally was broad-based and established new record highs for the S&P 500 and the Dow Jones Industrial Average, which traded above 40,000 for the first time. The tail end of earnings saw disappointing results from Home Depot, while Walmart showed increased traffic from more affluent customers. MEME stocks were back in vogue, with GameStop and AMC exhibiting extreme volatility. The increased speculation within these issues prompted caution from some investors, who suggested that this activity could insinuate too much speculation in the market. Wild swings in some commodities this week gave more weight to the idea of an overly speculative market.

The S&P 500 continued its impressive performance, increasing by 1.5%, and is now higher by 11.2% year-to-date. The Dow closed above 40,000 with a 1.2% advance, the NASDAQ led with a gain of 2.1%, and the Russell 2000 added 1.7%.

US Treasuries rallied across the curve, with longer-tenured paper outperforming. The 2-year yield fell by five basis points to 4.82%, while the 10-year yield dropped by eight basis points to 4.42%. The 2-10 spread compressed to -40 basis points.

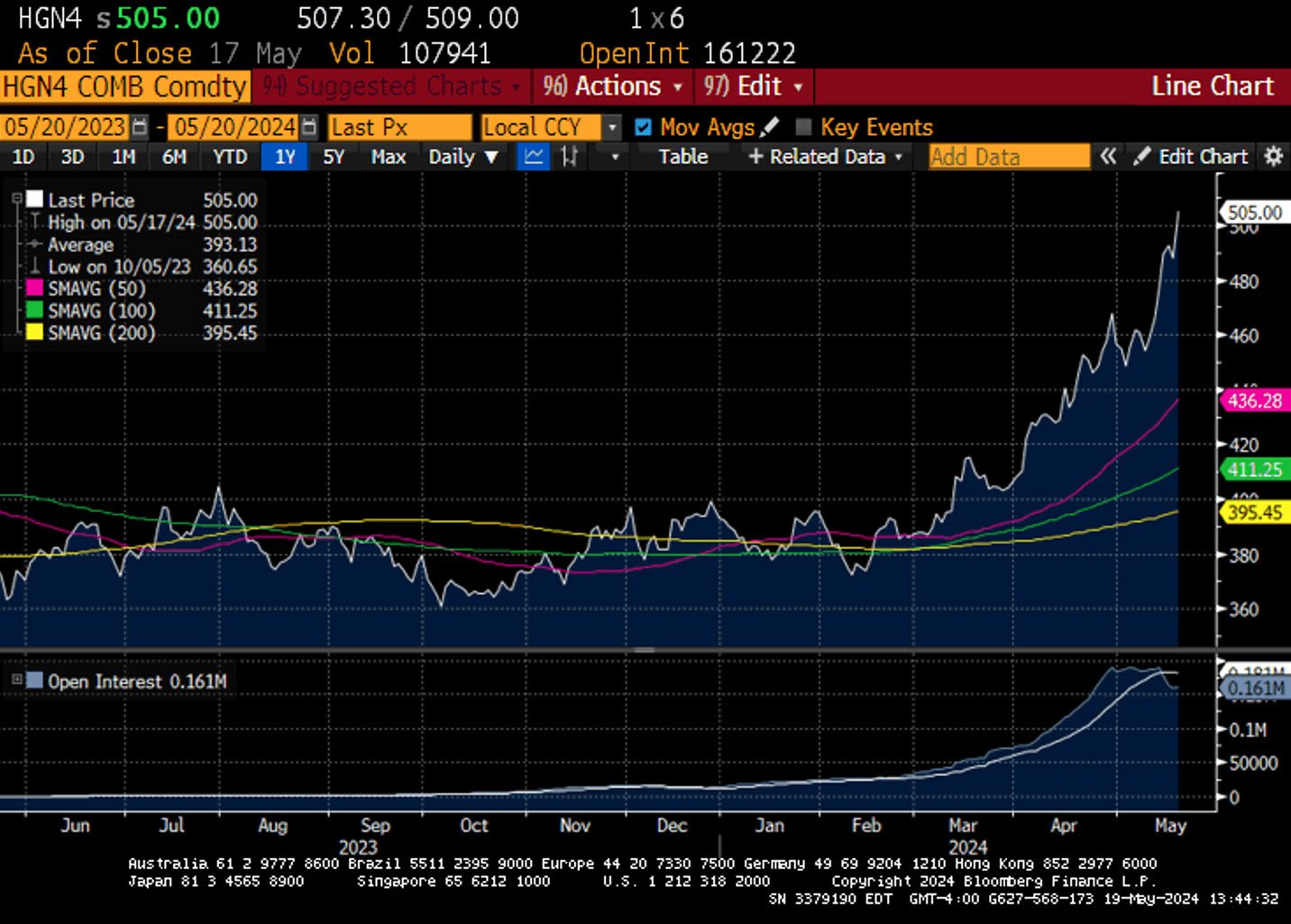

Gold prices increased by 1.8% to $2418.10. Copper prices rose by 8.3% this week as trades got caught in a short squeeze that induced the exchanges to increase margins. Nickel prices increased by over 5% as key processing factories in New Caledonian were poised for closure due to violent protests over voting rights. Oil prices increased by 1.6% or $1.26 to close at $79.54. Increased input costs from commodities will support the idea of sticky inflation. The US dollar index increased by 0.8% to 104.46.

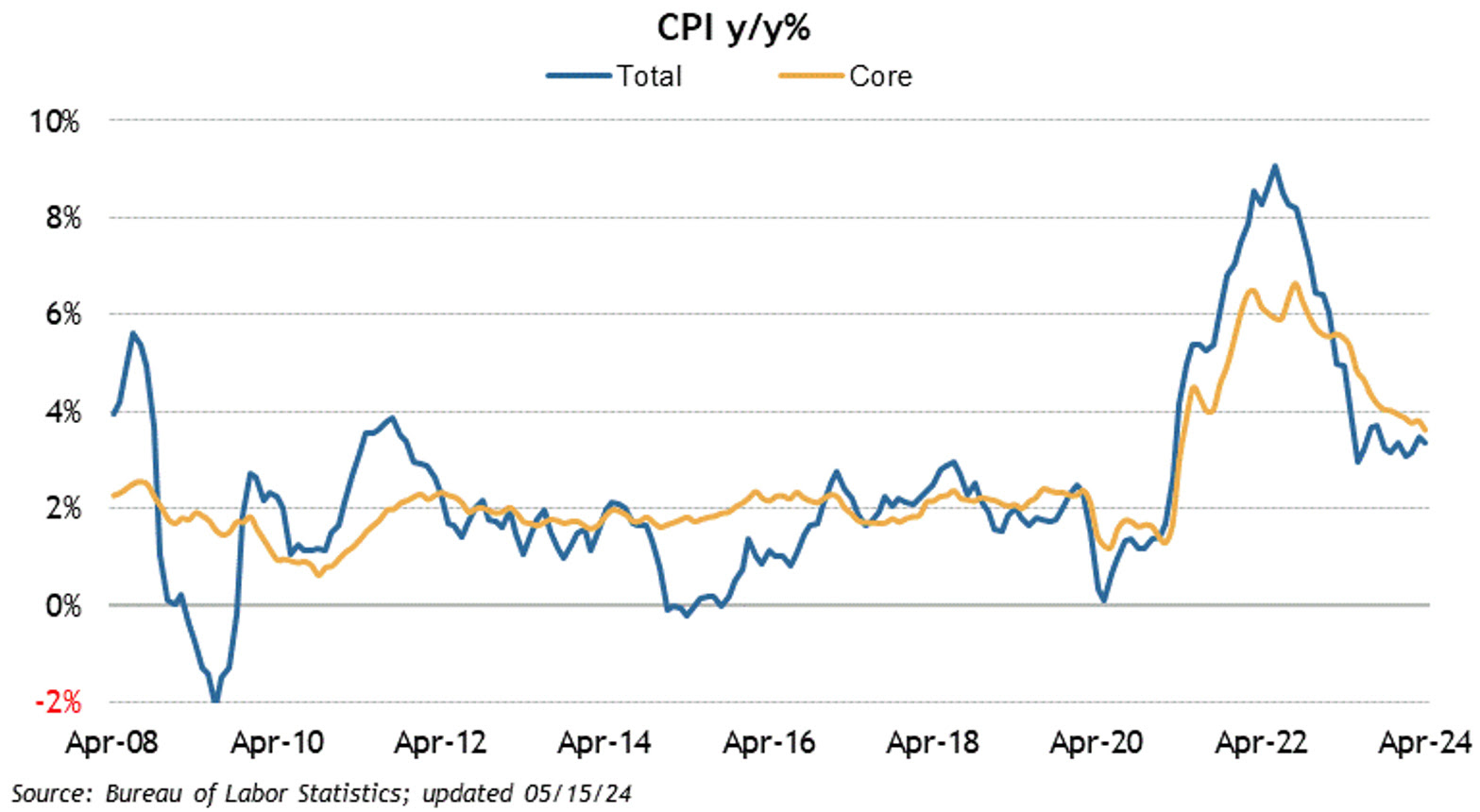

The economic calendar was highlighted by the April CPI print. Headline CPI increased by 0.3% on a month-over-month basis versus an expected increase of 0.4%. On a year-over-year basis, CPI was up 3.4% in April, down from 3.5% in March. Core CPI, which excludes food and energy, increased by 0.3%, in-line with the street’s expectations. Core CPI was up 3.6% yearly, down from 3.8% in March. Notably, shelter costs rose 0.4% in April and was up 5.5% year-over-year. April headline PPI increased by 0.5%, higher than the anticipated 0.3%. Core PPI was also hotter than expected, coming in at 0.5% versus the estimated 0.2%. Retail sales came in flat versus the estimate of 0.2%, while the Ex-auto figure came in line with estimates at 0.2%. Initial Claims fell by 10k from the prior week to 222k, while Continuing Claims increased by 13k to 1.794M. Housing Starts and Building Permits were weaker than expected, coming in at 1360k and 1440K, respectively.

Investment advisory services offered through Foundations Investment Advisors, LLC (“FIA”), an SEC registered investment adviser. FIA’s Darren Leavitt authors this commentary which may include information and statistical data obtained from and/or prepared by third party sources that FIA deems reliable but in no way does FIA guarantee the accuracy or completeness. All such third party information and statistical data contained herein is subject to change without notice. Nothing herein constitutes legal, tax or investment advice or any recommendation that any security, portfolio of securities, or investment strategy is suitable for any specific person. Personal investment advice can only be rendered after the engagement of FIA for services, execution of required documentation, including receipt of required disclosures. All investments involve risk and past performance is no guarantee of future results. For registration information on FIA, please go to https://adviserinfo.sec.gov/ and search by our firm name or by our CRD #175083. Advisory services are only offered to clients or prospective clients where FIA and its representatives are properly licensed or exempted.