US equity markets tapped on the brakes with modest losses across the board. The notion that higher rates will further dampen global economic growth gave investors reason to take some profits. Economic data painted a resilient economy but continued to show signs of slowing.

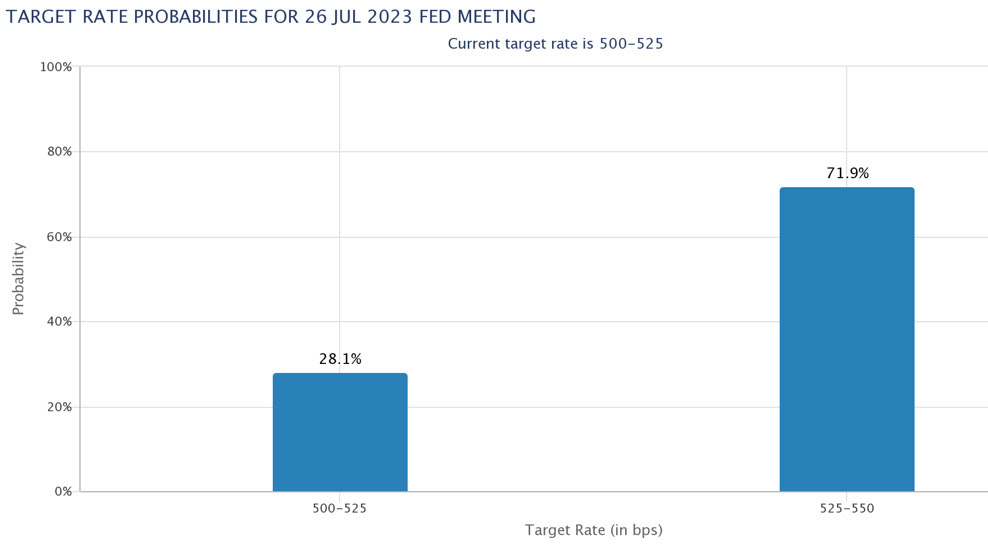

Global Central Banks’ rhetoric continued targeting elevated inflation and a vow to increase policy rates to lower prices. Federal Reserve Jerome Powell was in front of the Congressional Financial Services Committee and the Senate Banking Committee for his semi-annual testimony, reiterating that two more rate hikes are likely despite the pause in June. The Bank of England raised its policy rate by 50 basis points on the back of a hot UK CPI print. The Norges Bank increased its policy rate by 50 basis points, while the Swiss National Bank upped its rate by 25 bps.

Of note, China’s central bank has been adding more stimulus to its economy by lowering key lending rates, but despite its efforts, investors appear to think more is needed. Chinese markets fell over the week. Indian Prime Minister Modi met with President Biden and Congress to strengthen relations between the two countries. The Prime Minister also met with corporate executives from Amazon, GE, and Tesla to foster new investment within the Indian economy.

The S&P 500 lost 1.4%, the Dow fell 1.7%, the NASDAQ gave up 1.4%, and the Russell 2000 lagged, losing 2.9%. US Treasuries lost on the front end of the curve, while longer-tenured issues had slight gains. The 2-year yield increased by four basis points to 4.75%, as the 10-year yield fell by three basis points to 3.74%. Despite a draw in weekly crude inventories, WTI prices continued to struggle. Oil prices fell 3.8% or $2.74 to $69.18 a barrel. Gold prices fell by $40.40 to $1930.90 an Oz, while Copper prices regressed by $0.09 to close at $3.80 an Lb.

Economic data showed improvement in the housing sector. MDA mortgage applications increased for the second week in a row, while Housing Starts and Permits surprised meaningfully to the upside. Existing home sales fell by 20.4% year over year but came in better than expected at 4.30 million, highlighting the low supply of homes for sale. Initial Jobless claims continued to exceed 260k, coming in at 264K. Continuing Claims fell from the prior week to 1.759 million. Leading Economic indicators fell for the 14th consecutive time, coming in at -0.7 versus the previous reading of -0.8%. Preliminary June IHS global PMIs showed manufacturing in contraction in the US, Eurozone, and Japan. Services continue to show expansion but continue to moderate.

Investment advisory services offered through Foundations Investment Advisors, LLC (“FIA”), an SEC registered investment adviser. FIA’s Darren Leavitt authors this commentary which may include information and statistical data obtained from and/or prepared by third party sources that FIA deems reliable but in no way does FIA guarantee the accuracy or completeness. All such third party information and statistical data contained herein is subject to change without notice. Nothing herein constitutes legal, tax or investment advice or any recommendation that any security, portfolio of securities, or investment strategy is suitable for any specific person. Personal investment advice can only be rendered after the engagement of FIA for services, execution of required documentation, including receipt of required disclosures. All investments involve risk and past performance is no guarantee of future results. For registration information on FIA, please go to https://adviserinfo.sec.gov/ and search by our firm name or by our CRD #175083. Advisory services are only offered to clients or prospective clients where FIA and its representatives are properly licensed or exempted.