US equity markets fell for the third consecutive week. The S&P 500 broke its 50-day moving average and then sank below 4400. The sell-off has been on low volume, and the market may have been due to some consolidation after running hot for most of the spring and early summer. Fears that China’s economic struggles will spill over to the global economy have weighed on investment sentiment. Weak economic numbers out of China, including Retail Sales, Industrial Production, and fixed asset investment, and the announcement that Evergrande, a troubled property developer, had declared Chapter 15 bankruptcy, only fostered these concerns. The bond rating firm Fitch also cast a shadow on the health of US financials when it announced it had put multiple banks on notice of possible downgrades. Also not helping was last month’s Federal Open Market Committee minutes revealed that most of the committee continues to see significant inflation risks. Fed Funds futures predict a 33% chance of another 25 basis point hike by the November 1st meeting.

The S&P 500 fell 2.1%, the Dow lost 2.2%, the NASDAQ gave up 2.6%, and the Russell 2000 was lower by 3.4%. US Treasuries continued to sell off, with the sell-off more profound in longer-dated tenures. The 2-10 spread compressed to 66 basis points as the yield curve steepened. The 2-year yield increased by two basis points to 4.91%, while the 10-year yield increased by eight basis points to close at 4.25%. Notably, the 10-year yield hit the highest level since 2007, when it touched 4.35%. More supply, coupled with the notion that the Fed may need to keep rates higher for longer, has continued to put upward pressure on yields. There will be 16 billion in 20-year bonds auctioned this week and given the poor 30-year auction from a couple of weeks ago, investors will be closely watching its results. Oil prices fell by $2.54 or 3.1% to close at $80.66 a barrel. Gold prices were lower by $29.90, closing at $1916.70 an Oz. Copper prices were little changed at 3.70 a Lb. Notably, Bitcoin fell to $26,000, down significantly from the trading range it has been in for the last several weeks. As you can see, it was a tough week on Wall Street, with most asset classes declining- one exception was the US Dollar which eked out a small gain for the week.

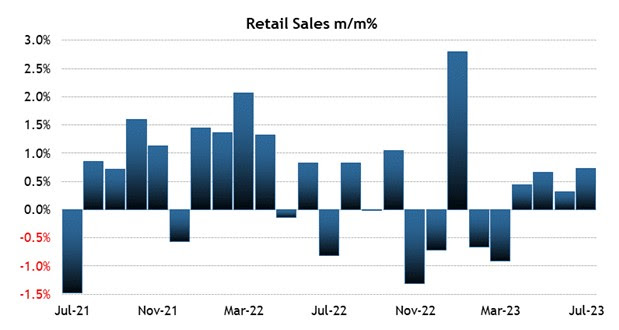

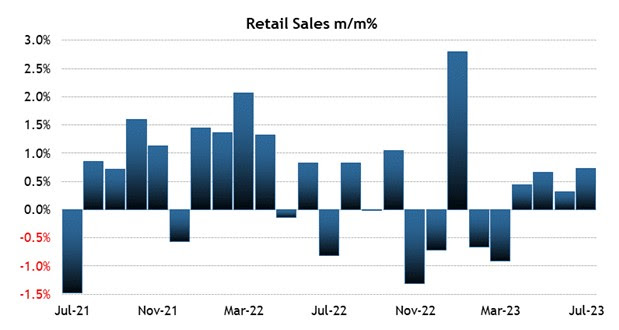

Economic data for the week included a better than expected Retail Sales print. The headline number was 0.7% versus the street consensus of 0.5%. The Ex-auto reading was also better than expected, coming in at 1%. US retailers Walmart, Target, and TJ Max posted solid earnings results, although Walmart traded lower after their announcement. Industrial production came in at 1% versus the 0.1% expectation. Housing starts and Building permits were roughly in line with expectations. Initial Claims came in at 239k, while Continuing Claims ticked higher to 1716k.

Investors in the coming week will be listening to plenty of Fed rhetoric from the Kansas City Fed’s annual symposium at Jackson Hole. A fresh set of Global PMIs will be released and assess the state of manufacturing and services. The final reading for August University of Michigan’s Consumer Sentiment will also be announced.

Investment advisory services offered through Foundations Investment Advisors, LLC (“FIA”), an SEC registered investment adviser. FIA’s Darren Leavitt authors this commentary which may include information and statistical data obtained from and/or prepared by third party sources that FIA deems reliable but in no way does FIA guarantee the accuracy or completeness. All such third party information and statistical data contained herein is subject to change without notice. Nothing herein constitutes legal, tax or investment advice or any recommendation that any security, portfolio of securities, or investment strategy is suitable for any specific person. Personal investment advice can only be rendered after the engagement of FIA for services, execution of required documentation, including receipt of required disclosures. All investments involve risk and past performance is no guarantee of future results. For registration information on FIA, please go to https://adviserinfo.sec.gov/ and search by our firm name or by our CRD #175083. Advisory services are only offered to clients or prospective clients where FIA and its representatives are properly licensed or exempted.