Markets finished a difficult month of September with mixed results. The prospect of a government shutdown, along with no real progress in the UAW negotiations and a recalibration of interest rate expectations, were prominent factors for traders to consider.

As I write, a government shutdown has been avoided as Speaker McCarthy reached across the aisle and dismissed the far-right representatives of his party. The Senate passed the stop-gap measure to keep the government open until mid-November.

Friday afternoon, the UAW announced that more workers would go on Strike at Ford and GM plants, while the union did not organize a strike at Stellantis. Negotiations enter their third week with strike measures engaged and reportedly very little progress. Of note, the Hollywood Writers Guild was able to come to terms with the studios after five months of negotiations, while Las Vegas Strip workers this week voted to approve a strike.

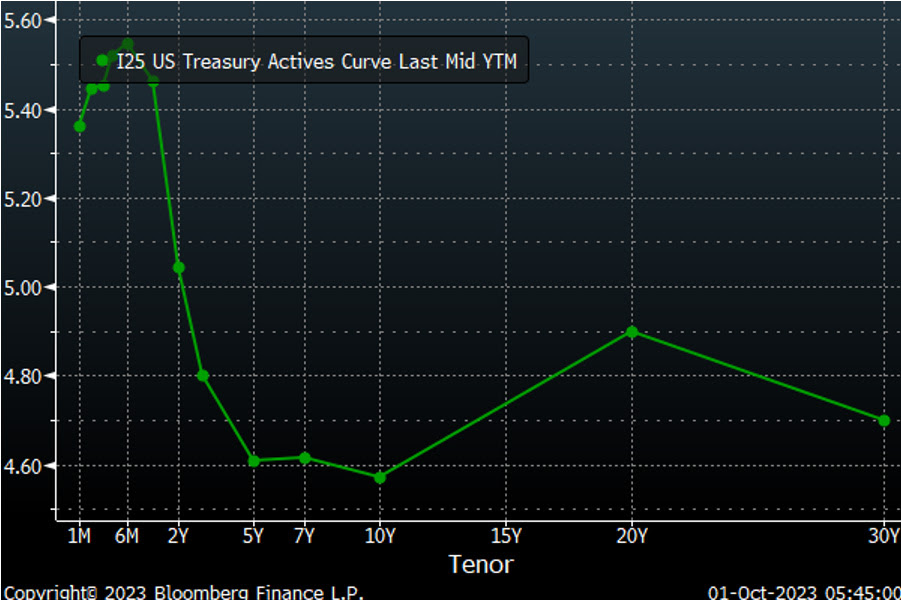

The Treasury market was mixed this week, with the front end of the curve trading higher while the longer end of the curve continued to sell off. The 2-year yield declined by eight basis points to 5.04% but its yield increased by eighteen basis points in September. The 10-year yield increased by thirteen basis points for the week and was up forty-eight basis points in September to close at 4.57%. The increase in rates was a strong headwind for the markets in September. The Fed’s hawkish rhetoric and projections for higher rates for longer seem to have been noticed by the street. Prominent figures Jamie Diamond, Bill Ackman, and Larry Fink indicated that the 10-year could easily eclipse 5% in the coming weeks.

The S&P 500 lost 0.7% and was down 5.7% for the month of September. The Dow gave back 1.3% and shed 3.65% for the month. The NASDAQ increased by 0.1% but inked a 7.79% loss in September. The Russell 2000 managed a 0.5% gain but fell 6.46% for the month.

Oil prices increased by over $7.00 for the month and $0.51 for the week to close at $90.78. There is no indication that OPEC will alter its production at the October meeting. Gold fell 4% on the week, or $78.10, to close at $1867.60. Copper prices increased by $0.03 to 3.73 an Lb. The US Dollar index came off its recent highs as other central banks indicated more intervention in currency markets.

Economic data reported for the week included the Fed’s preferred measure of inflation, the PCE. Headline PCE came in at 0.4%, in line with expectations but up 3.5% year-over-year from July’s figure of 3.4%. Core PCE came in at 0.1%, less than the estimate of 0.4%. Core PCE on a year-over-year basis fell to 3.9% from July’s 4.3%. The third estimate of Q2 GDP was as expected at 2.1%, while the GDP Deflator estimate fell to 1.7%. August Personal Income came in at 0.4%, in line with estimates, and Personal Spending came in at 0.4%, a bit lighter than anticipated. Initial Claims came in at 204k, and Continuing Claims climbed by 12k to 1670k. The final reading of the University of Michigan’s Consumer Sentiment for September was 68.1, which was slightly better than expectations of 67.3.

Investment advisory services offered through Foundations Investment Advisors, LLC (“FIA”), an SEC registered investment adviser. FIA’s Darren Leavitt authors this commentary which may include information and statistical data obtained from and/or prepared by third party sources that FIA deems reliable but in no way does FIA guarantee the accuracy or completeness. All such third party information and statistical data contained herein is subject to change without notice. Nothing herein constitutes legal, tax or investment advice or any recommendation that any security, portfolio of securities, or investment strategy is suitable for any specific person. Personal investment advice can only be rendered after the engagement of FIA for services, execution of required documentation, including receipt of required disclosures. All investments involve risk and past performance is no guarantee of future results. For registration information on FIA, please go to https://adviserinfo.sec.gov/ and search by our firm name or by our CRD #175083. Advisory services are only offered to clients or prospective clients where FIA and its representatives are properly licensed or exempted.