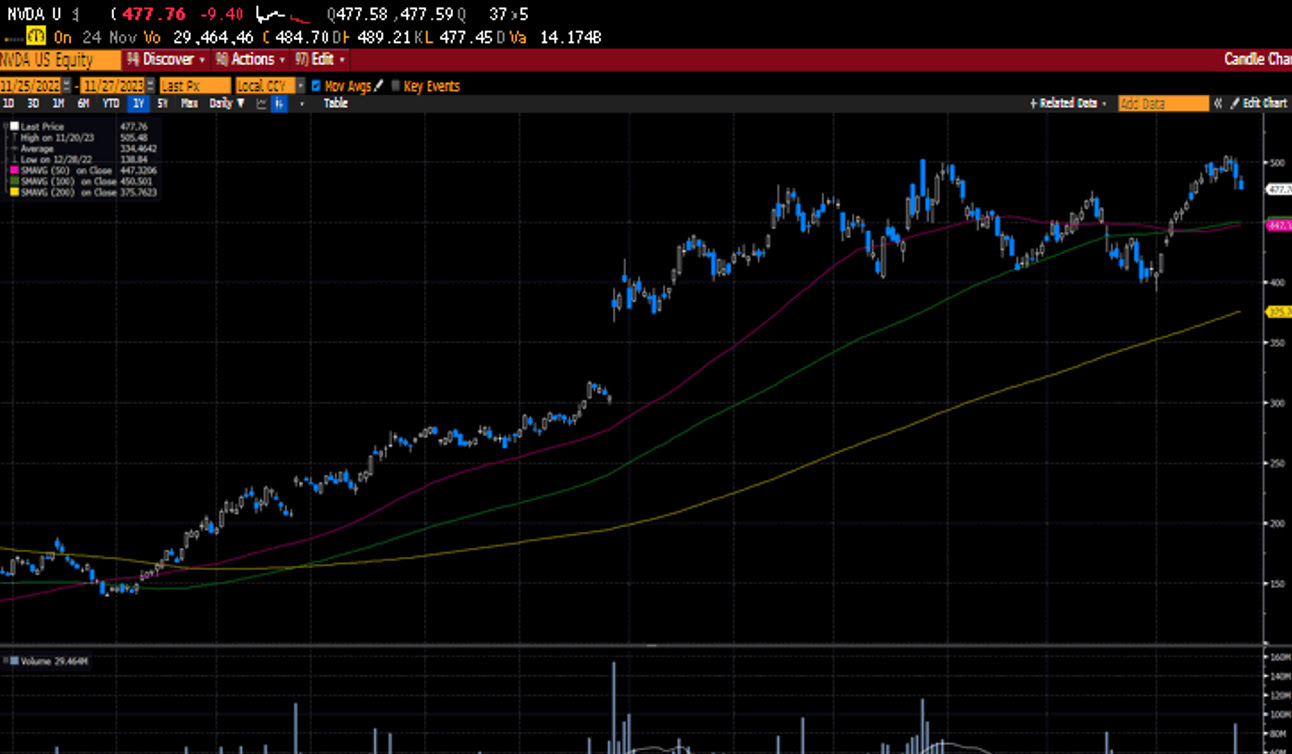

US equity markets inked a 4th straight week of gains despite the market appearing to be overbought. The holiday-shortened week featured light trading volumes and broad participation. Earnings results from AI Chip maker NVidia were absolutely stellar, however, the results were met with selling pressure. The stock had advanced nearly 25% in four weeks and the move post earnings may be indicative of what we should start to expect from the broader market. Earnings results for a number of retailers were mixed, but on the margin fostered the sense that the consumer is still quite resilient. The markets will be interested to see how Black Friday Sales come in, with preliminary data suggesting flat results over last year. Israel and Hamas agreed to a four-day cease-fire as they exchanged hostages and prisoners. Oil prices were little changed on the news but did react to news that the OPEC+ meeting would be delayed as some members apparently disagreed with another tranche of production cuts.

The S&P 500 gained 1% for the week and is up 10.6% over the last four weeks. The Dow added 1.3%, the NASDAQ increased by 0.9%, and the Russell 2000 rose by 0.5%. Mega Caps gained 1.2%, while the S&P 500 equal-weighted index increased by 1%. US Treasury yields increased across the curve but the moves were rather subdued compared to the last several weeks. The 2-year yield increased by five basis points to 4.95%, while the 10-year yield rose by three basis points to 4.47%. Minutes from last month’s FOMC meeting offered investors a reiteration of the Fed’s current data-dependent stance.

Oil prices decreased by $0.82 to close at $75.18 a barrel. Gold prices reclaimed the $2000 threshold, gaining $18.90 to close at $2003.40 an Oz. Copper prices increased by 0.05 to $3.79 a Lb. The dollar index lost ground again this week as the Euro, Yen, Yuan, and British Pound all gained against the greenback.

The Economic calendar was fairly light. October leading indicators declined by 0.8%, slightly lower than the consensus estimate of -0.7%. October Existing Home Sales came in lighter than expected at 3.79 million as higher mortgage rates and lack of supply hindered sales. Durable Goods orders also came in lighter than expected at -5.4%- the street was looking for -3.1%. Initial Jobless Claims fell by 24k to 209k while Continuing Claims fell by 22k to 1.840 million. The final November reading of the University of Michigan Consumer Sentiment Index came in at 61.3 versus the October reading of 63.8.

Investment advisory services offered through Foundations Investment Advisors, LLC (“FIA”), an SEC registered investment adviser. FIA’s Darren Leavitt authors this commentary which may include information and statistical data obtained from and/or prepared by third party sources that FIA deems reliable but in no way does FIA guarantee the accuracy or completeness. All such third party information and statistical data contained herein is subject to change without notice. Nothing herein constitutes legal, tax or investment advice or any recommendation that any security, portfolio of securities, or investment strategy is suitable for any specific person. Personal investment advice can only be rendered after the engagement of FIA for services, execution of required documentation, including receipt of required disclosures. All investments involve risk and past performance is no guarantee of future results. For registration information on FIA, please go to https://adviserinfo.sec.gov/ and search by our firm name or by our CRD #175083. Advisory services are only offered to clients or prospective clients where FIA and its representatives are properly licensed or exempted.