- Who We Are

- Empower Solutions

- Media Library

-

Featured

Local Financial Advisor Completes Advanced IRA Training at National 20-Year Conference Hosted by America’s...No posts found

-

- Events

- Form CRS

- Contact

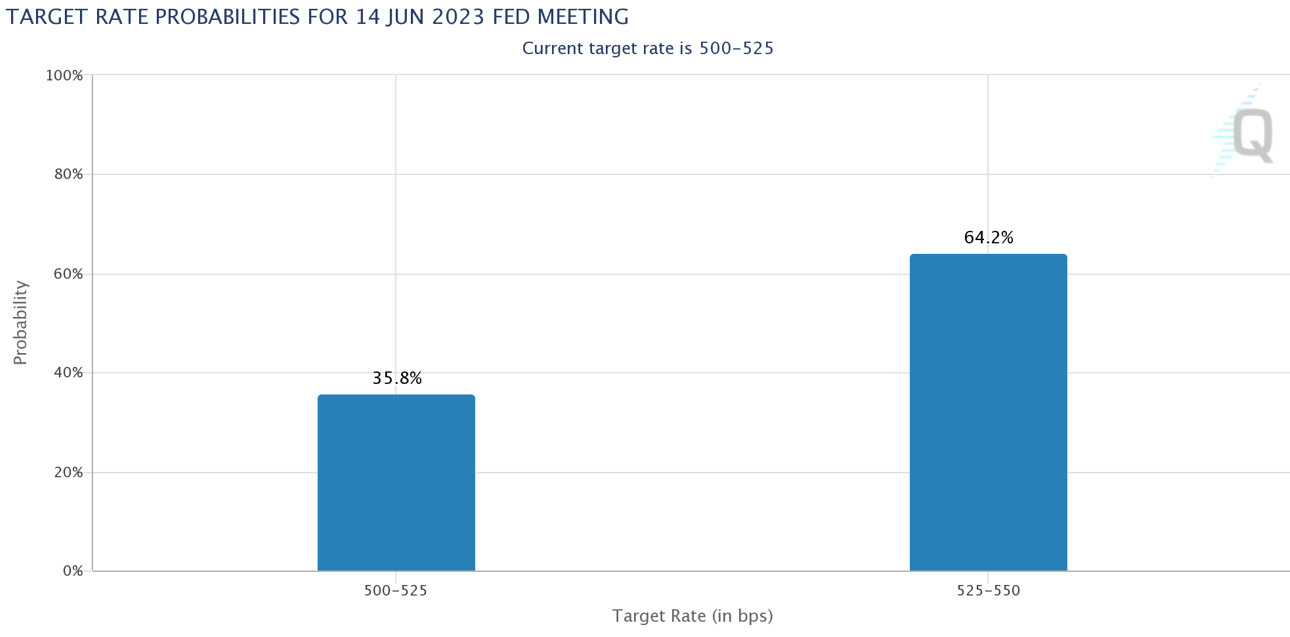

As investors awaited news from the debt ceiling negotiations, markets continued to ebb and flow. The S&P 500 continued to trade range-bound, oscillating between 4100 and 4200. Fed rhetoric continued to open the door for another set of interest rate hikes and hammered the front end of the yield curve. Economic data reported during the week seemed to substantiate the need for more rate hikes as Fed Fund Futures saw the probability of a June rate hike move to 64.2% from nearly zero three weeks ago. A blowout quarter and an optimistic outlook from semiconductor chip designer NVidia highlighted the last stint of first-quarter earnings. The stellar report prompted another rally in mega-cap technology issues that have accounted for most of this year’s market returns.

The S&P 500 gained 0.3%, the Dow lost 1%, the NASDAQ increased by 2.5%, and the Russell 2000 traded unchanged. US Treasuries endured another steep selloff as yields across the curve rose—bond price fall when their yields increase. The 2-year yield increased by twenty-nine basis points to 4.56% while the 10-year yield rose by eleven to 3.8%.

Oil prices increased by 1.1% or $0.79 to close at $72.55 a barrel. Gold prices fell 1.9% or $38.40 to $1943.4. Copper prices continued to struggle, closing down $0.06 to $3.67 an Lb.

The dollar strengthened against the Yen, Euro, British Pound, and Yuan. China voiced concern over the recent appreciation of the US Dollar relative to its currency.

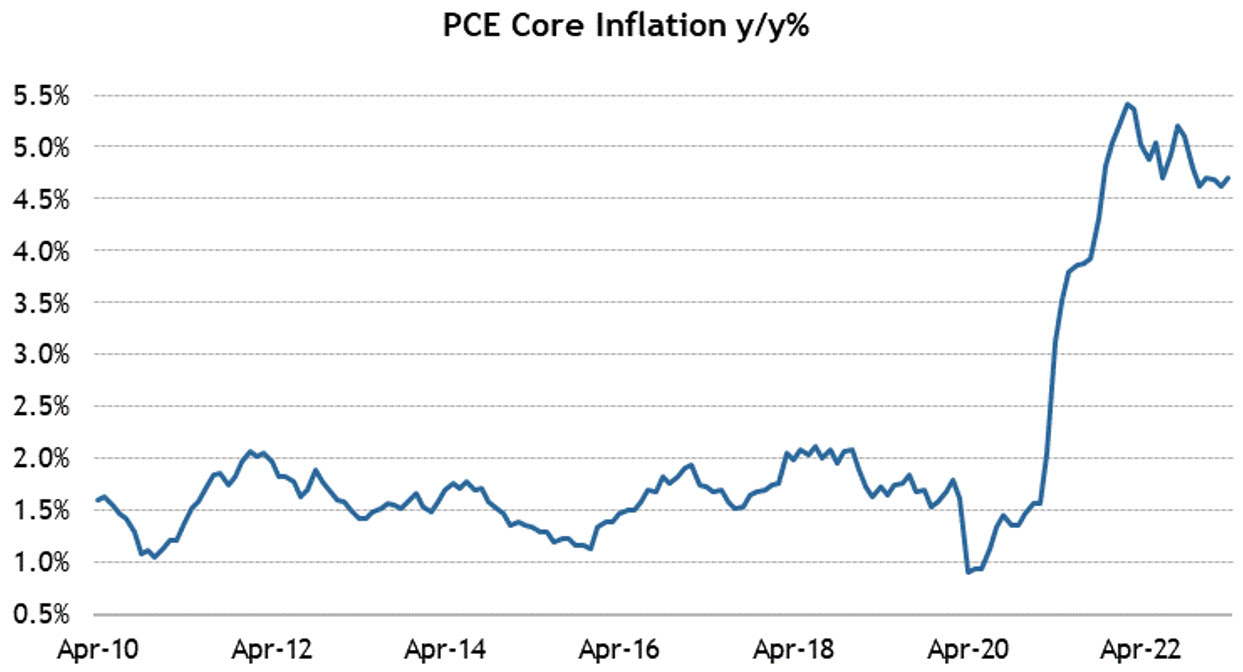

US economic data reported for the week showed a resilient economy. First quarter GDP figures came in strong than expected at 1.3% growth versus the expectation of 1.1%. German GDP contracted for the second quarter in a row, putting the country into a technical recession defined as two consecutive quarters of negative growth. The US labor market only showed 229k initial jobless claims; the street was looking for 250k. Continuing Claims also fell to 1794k from 1799k in the prior week. Personal Spending increased to 0.8% in April, higher than the anticipated 0.4%, highlighting the strength of the consumer. Personal income increased to 0.4%. The Fed’s preferred measure of inflation, PCE, came in hotter than expected. The headline number came in at 0.4% versus the estimated 0.3% month-over-month and was up 4.4% year-over-year from March’s 4.2%. The Core reading was also up 0.4% over March and increased 4.7% annually. New Home Sales increased to 683K, better than the expected 670. Consumer Sentiment also ticked a bit higher in May, with the University of Michigan’s data showing a reading of 59.2, up from the last preliminary reading of 58.

Investment advisory services offered through Foundations Investment Advisors, LLC (“FIA”), an SEC registered investment adviser. FIA’s Darren Leavitt authors this commentary which may include information and statistical data obtained from and/or prepared by third party sources that FIA deems reliable but in no way does FIA guarantee the accuracy or completeness. All such third party information and statistical data contained herein is subject to change without notice. Nothing herein constitutes legal, tax or investment advice or any recommendation that any security, portfolio of securities, or investment strategy is suitable for any specific person. Personal investment advice can only be rendered after the engagement of FIA for services, execution of required documentation, including receipt of required disclosures. All investments involve risk and past performance is no guarantee of future results. For registration information on FIA, please go to https://adviserinfo.sec.gov/ and search by our firm name or by our CRD #175083. Advisory services are only offered to clients or prospective clients where FIA and its representatives are properly licensed or exempted.