US markets rallied on the notion that the economy may be able to execute a soft landing as inflation wanes and employment continues to hold up. Inflation data reported during the week showed moderating prices at the consumer and wholesale levels. Q2 earnings season kicked off with better-than-expected earnings from financials: JP Morgan, Citibank, and Wells Fargo. United Healthcare, Delta Airlines, and Pepsi also beat their earnings expectations. China announced new stimulus efforts, while Sweden got the nod to become a NATO member.

A broad-based rally saw the S&P 500 gain 2.4% on the week. The Dow added 2.3%, the NASDAQ advanced 3.3%, and the Russell 2000 jumped 3.6%. US Treasuries rallied on the weaker inflation data, with the 2-year yield coming down twenty-one basis points to 4.73%. The 10-year yield fell by twenty-three basis points to close at 3.82%. A perceived divergence in the path of central bank policies hit the US dollar index, which fell by 2.4% over the week. Fed rhetoric during the week was skewed to more tightening, and while Fed Fund Futures project a near certainly of a July 25 basis point hike, the projections of another hike fell on this week’s pricing data.

Oil prices increased by 2% or $1.55, with WTI closing at $75.40 a barrel. Gold prices jumped by 1.5% or $30.7 to 1964.40 an Oz. Copper prices increased by 4% to close at 3.93 a Lb.

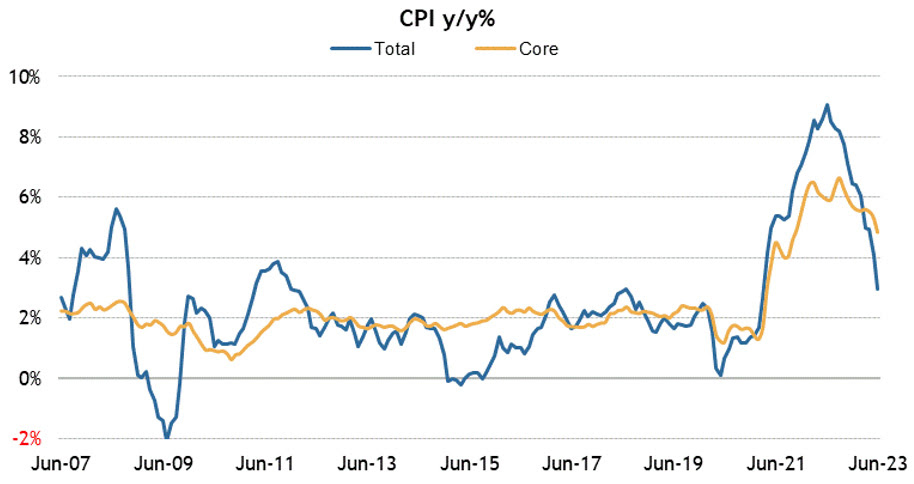

The Consumer Price Index highlighted economic data for the week. The headline CPI and Core CPI for June came in at 0.1% less than the expected 0.2%. On a year-over-year basis, CPI came in at 3%, down from 4% in May. The Core year-over-year reading decreased to 4.8% from 5.3% in May. Wholesale prices tracked by the Producer Price Index also saw prices moderating. Headline PPI came in at 0.1% versus the expected 0.2% and was up just 0.1% on a year-over-year basis, down from May’s increase of 1%. Core PPI increased by 0.1% in June and fell to 2.4% from 2.6% in May year-over-year. Export prices fell by 0.9%. Initial Unemployment Claims came in below estimates at 237k, while Continuing Claims came in at 1729k, up slightly from the prior week’s reading of 1718k. The University of Michigan’s preliminary read on the July Consumer Sentiment came in better-than-expected at 72.6 versus the consensus expectation of 66.

Investment advisory services offered through Foundations Investment Advisors, LLC (“FIA”), an SEC registered investment adviser. FIA’s Darren Leavitt authors this commentary which may include information and statistical data obtained from and/or prepared by third party sources that FIA deems reliable but in no way does FIA guarantee the accuracy or completeness. All such third party information and statistical data contained herein is subject to change without notice. Nothing herein constitutes legal, tax or investment advice or any recommendation that any security, portfolio of securities, or investment strategy is suitable for any specific person. Personal investment advice can only be rendered after the engagement of FIA for services, execution of required documentation, including receipt of required disclosures. All investments involve risk and past performance is no guarantee of future results. For registration information on FIA, please go to https://adviserinfo.sec.gov/ and search by our firm name or by our CRD #175083. Advisory services are only offered to clients or prospective clients where FIA and its representatives are properly licensed or exempted.